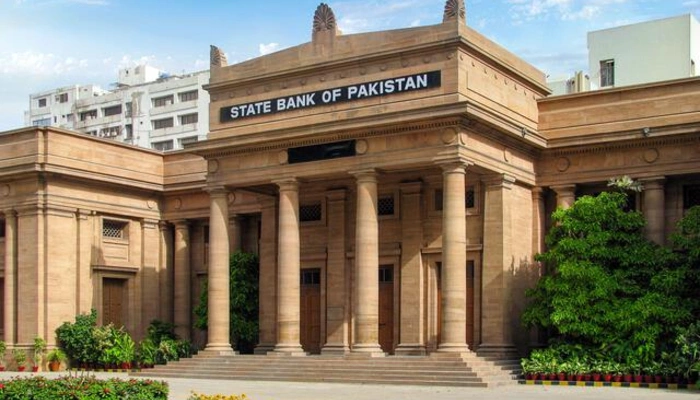

ISLAMABAD: Pakistan achieved a major economic milestone in March 2025, recording a record-breaking $1.2 billion current account surplus, according to the latest data released by the State Bank of Pakistan (SBP). This historic monthly surplus marks a sharp reversal from the deficits posted in January and February, signaling a potential recovery in the country’s external balance.

Surplus Driven by Strong Remittances and Lower Imports

SBP data revealed that the surge in workers’ remittances, along with a decline in import bills, played a key role in flipping the current account to surplus territory. Remittances reached over $3 billion, largely fueled by overseas Pakistanis sending funds ahead of Ramadan and Eid.

Simultaneously, a significant drop in import payments, particularly for fuel and non-essential goods, helped ease pressure on the current account. The government’s tight fiscal controls and currency stability measures have further contributed to this unexpected economic turnaround.

March Breaks All-Time Record

The $1.2 billion surplus in March is the highest ever monthly current account surplus recorded in Pakistan’s economic history. Previously, the country had struggled with recurring deficits that drained foreign exchange reserves and heightened pressure on the Pakistani rupee.

This surplus also provides a cushion for the country’s foreign reserves, giving policymakers more room to manage external debt payments and stabilize the financial system.

Read: Pakistan’s Foreign Reserves Hold Steady Amid External Debt

Positive Signal for Investors and IMF Talks

The record surplus has arrived at a crucial time, as Pakistan continues to engage with the International Monetary Fund (IMF) for a new bailout program. A healthier current account strengthens the government’s position in negotiations and may boost investor confidence.

Financial experts suggest that if this trend continues, Pakistan could reduce its reliance on foreign loans, stabilize the rupee, and attract more foreign direct investment (FDI).

Economic Caution Still Advised

Despite the positive development, economists warn that sustained structural reforms are needed to maintain long-term balance. One-time improvements, like seasonal remittance flows or reduced imports, might not ensure future stability.

Authorities must continue to diversify exports, increase industrial productivity, and control inflation to prevent slipping back into a deficit cycle in the coming months.

Public Response and Market Outlook

News of the surplus quickly circulated on social media, with many hailing it as a turning point for Pakistan’s struggling economy. The stock market responded positively, with key indices showing upward momentum amid optimism for broader macroeconomic improvement.

The government, meanwhile, emphasized its commitment to financial discipline and sustainable growth, pledging to build on this momentum.

Follow us on Google News, Instagram, YouTube, Facebook, Whats App, and TikTok for latest updates