The National Electric Power Regulatory Authority (Nepra) has approved a 14% dollar-based return on equity (RoE) for K-Electric’s distribution business. This translates into a hefty 29.68% return in Pakistani rupees for the fiscal year 2023-24.

Nepra also sanctioned a 12% dollar-denominated RoE for K-Electric’s transmission segment. In local currency, this amounts to a 24.46% return for the same fiscal year.

Govt, Industry Oppose Move

The Ministry of Energy (Power Division) sharply opposed these foreign currency-linked returns. It called the decision “unjustified” and inconsistent with the returns offered to public sector utilities.

In its written comments, the ministry stated: “The RoE for transmission and distribution businesses should match those allowed to NTDC and state-run DISCOs.” Despite this objection, Nepra moved ahead with its approvals.

Tariffs Approved

For FY2023-24, Nepra approved an average distribution tariff of Rs3.31 per unit for K-Electric. This is lower than KE’s request for Rs3.84. The regulator also set the transmission system use-of-charge (UOSC) at Rs1,348.66/kW/month under the seven-year Multi-Year Tariff (MYT) plan for 2024–30.

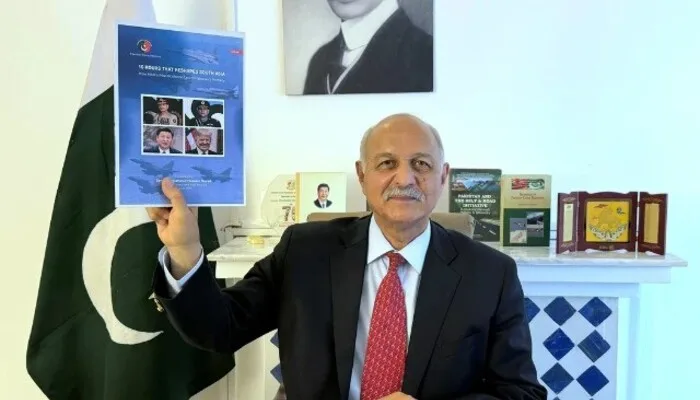

Read: AOAV Report: Gaza and Lebanon Hit Hardest by Explosive Weapons in 2024

Private Ownership Justified Dollar Returns

Nepra defended its decision by highlighting K-Electric’s private ownership, significant investment needs, and lack of sovereign guarantees. However, the authority hinted that these returns might be revisited in the future. “Once other DISCOs are privatised, the USD-based RoE may be revised downward or converted to PKR,” Nepra stated.

Industry Voices Concerns

Amreli Steels and other industry representatives strongly opposed the move. They argued that such high dollar-linked returns would increase costs for consumers already under economic stress.

Critics fear that indexing returns to the dollar exposes consumers to foreign exchange risks. They say it will lead to higher electricity bills as the rupee depreciates.

K-Electric Responds

K-Electric issued a statement acknowledging the decision but expressed concerns. It said, “While Nepra’s determinations are currently under review, an initial assessment shows that KE was allowed lower RoE than requested.”

KE added that it had sought returns similar to those allowed in the last MYT, but received only 14% for distribution and 12% for transmission. “This is less than what we had anticipated,” the company noted.

KE also pointed out issues with loss allowances. It said Nepra approved significantly lower loss percentages than what the company actually incurred. “This goes against industry practice, where previous actual losses are used as a baseline,” KE added.

Future Uncertainty

The decision has opened a debate about how private utilities should be regulated. With rising inflation, a weakening currency, and mounting public discontent, all eyes are now on how these tariffs will affect consumers and whether further revisions will follow.

Nepra’s move sets a precedent — one that could shape the power sector’s future, especially as more utilities move toward privatization.

Follow us on Facebook and Instagram