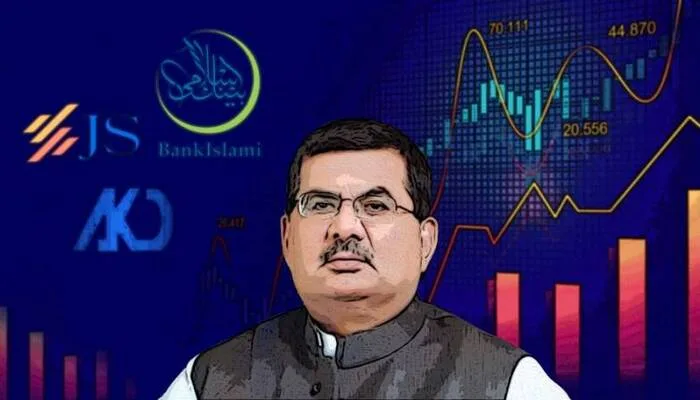

In a landmark decision, Pakistan has recorded its first-ever insider trading conviction, signaling a major shift in capital market enforcement. On June 17, 2025, the Sindh Special Court (Offences in Banks) convicted Zakir Hussain Somji, Assistant Vice President of Investments at Habib Metropolitan Bank Limited (HMB), for illegal trading based on non-public information.

SECP Leads Historic Case

The Securities and Exchange Commission of Pakistan (SECP) filed the case under Section 128 of the Securities Act, 2015, following a detailed inspection. The SECP flagged unusual trading activity using data from the Karachi Automated Trading System (KATS) covering the period from January 1, 2014, to February 2, 2016.

Abuse of Insider Access Uncovered

Investigators found that Somji exploited his role at HMB to access confidential information. He then used this information to buy 11.79 million shares — including 1.23 million shares from HMB — and later sold 11.83 million shares. Among them, 4.91 million were sold back to HMB. His actions yielded an unlawful profit of Rs. 2.86 million.

Read: Pakistan Recalls Non-Essential Diplomats from Iran Amid Tensions

Court Delivers Strong Verdict

After a full trial, the court found Somji guilty of insider trading. He was ordered to pay a penalty of Rs. 8.59 million — three times the amount of his illegal gain. If he fails to pay within seven days, he will be jailed until full payment is made.

SECP Sees Boost to Market Integrity

SECP Chairman Akif Saeed praised the legal team and welcomed the court’s verdict. He said the ruling would reinforce trust in Pakistan’s capital markets and send a strong signal to wrongdoers. He also hoped it would pave the way for resolving other pending cases of market manipulation and regulatory abuse.

However This conviction sets a crucial precedent for Pakistan’s financial sector, demonstrating that the era of unchecked market misconduct may be ending.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates