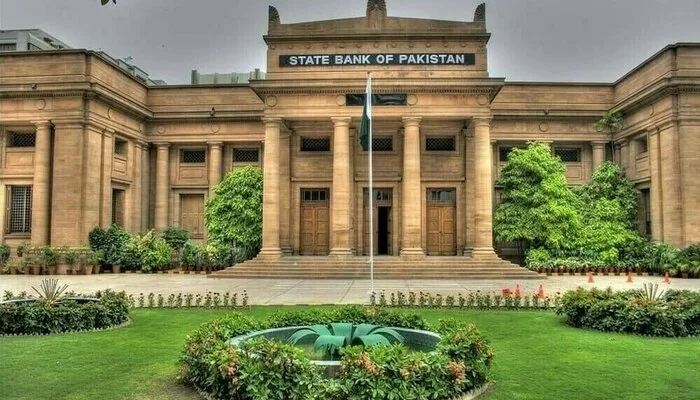

The State Bank of Pakistan (SBP) is set to launch PRISM+ digital upgrade—a major overhaul of the country’s national payment infrastructure—starting June 16, 2025. This initiative, introduced under SBP’s Vision 2028, aims to enhance transparency, efficiency, and security in digital transactions across financial institutions.

Key Features of PRISM+

PRISM+ is based on the ISO 20022 financial messaging standard. This globally accepted format allows richer, structured data in transactions, ensuring greater clarity, automation, and cross-platform compatibility.

The system will support new capabilities such as real-time liquidity management, payment scheduling, transaction queuing, and prioritization. Participants will be able to view and manage activities using a web-based dashboard with real-time alerts and downloadable reports.

Integration with Securities Market

Beyond digital payments, PRISM+ offers a Central Securities Depository (CSD) platform. This feature will handle money market operations like government securities auctions, secondary market trading, and open market operations. It also simplifies collateral management.

Read: Aurangzeb Unveils Relief-Focused Budget

Improved Settlement Mechanism

Each day, 80% of funds from financial institutions’ Current Accounts with SBP BSC Karachi will automatically transfer to their respective Transitory Accounts within PRISM+. Banks can freely move funds between these accounts during business hours, improving liquidity control.

Participants can also allocate specific funds for ancillary services such as Raast, NIFT, and 1Link. SBP has urged all banks to maintain adequate balances to reduce systemic risk and ensure smooth settlements.

Transition and Compatibility

To support the shift, PRISM+ will accommodate both MT and MX (ISO 20022 XML) message formats until September 30, 2025. After that, the legacy MT/MX converter will be phased out. Institutions must update their Straight-Through Processing (STP) systems using available APIs or file adapters.

Raast OTC for Branch Transactions

SBP also directed all participants to replace RTGS-based over-the-counter (OTC) branch transactions with Raast OTC by the end of September 2025.

Financial institutions are required to align their internal systems with PRISM+, retain historical transaction data, and ensure seamless operational readiness for the upcoming digital shift.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates