The federal government has unveiled strict non-filer restrictions in the Budget 2025–26 to expand the tax net and formalize the economy. Finance Minister Muhammad Aurangzeb announced sweeping changes aimed at discouraging tax evasion and enforcing compliance through limited financial access for non-filers.

Ban on Property and Vehicle Purchases

In a major policy shift, non-filers will no longer be allowed to purchase vehicles or immovable property. These restrictions aim to close loopholes that have allowed undocumented wealth to flow into high-value assets. Only those who submit tax returns and wealth statements will be permitted to make such transactions.

Investment Access Denied

The government also plans to bar non-filers from investing in securities or mutual funds. This measure targets financial market activity by individuals and entities operating outside the documented economy. By limiting access, the government hopes to compel non-filers to register and file their tax returns.

Read: Federal Budget 2025-26 Set for Presentation Today Amid Economic Shifts

Bank Accounts Off-Limits

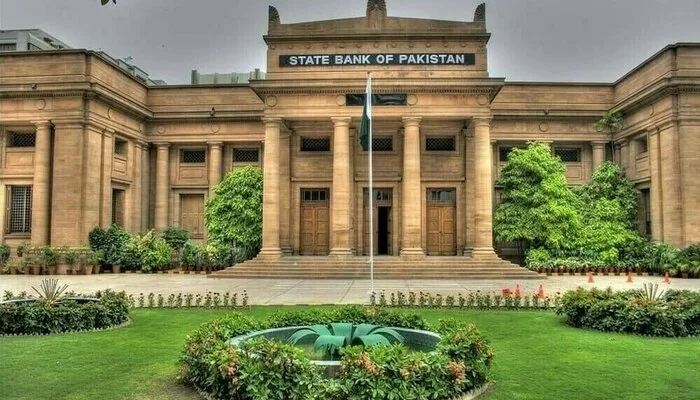

A significant proposal involves blocking non-filers from opening new bank accounts. This move would severely restrict their ability to conduct formal financial transactions, thus pressuring them into entering the tax system. It’s expected to impact undocumented cash flow and curb financial anonymity.

Increased Advance Tax on Cash Withdrawals

The budget proposes raising the advance tax on cash withdrawals by non-filers from 0.6% to 1%. This higher rate serves as both a financial deterrent and a tool to encourage documentation of income sources. It also aims to increase tax revenue through everyday transactions.

No More Distinction in Key Transactions

The finance minister noted that the government will remove the distinction between filers and non-filers in major financial dealings. This change ensures stricter compliance, with privileges reserved only for those who fulfill tax obligations.

If approved, these measures will mark one of the toughest crackdowns on non-filers in recent years, signaling the state’s renewed commitment to tax enforcement and economic transparency.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates