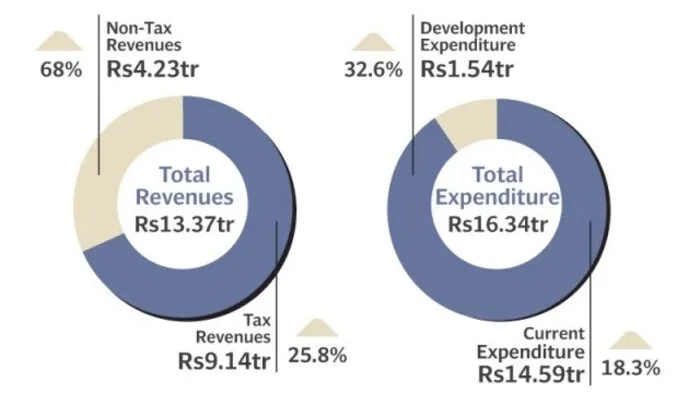

In a surprising turn, tax exemptions in Pakistan have soared to a record Rs5.8 trillion during the current fiscal year. The massive jump in tax exemptions comes despite the government’s efforts to withdraw several concessions. The keyword “tax exemptions” takes center stage as this unexpected spike raises serious questions about fiscal management.

Exemptions Rise Sharply in One Year

According to the Economic Survey of Pakistan 2025, tax exemptions have increased by Rs1.96 trillion—up 51% from last year’s Rs3.9 trillion. Finance Minister Muhammad Aurangzeb unveiled the figures during the budget presentation. Surprisingly, the rise occurred even after the government removed many previous exemptions in the last budget.

Sales Tax Losses Lead the Surge

Sales tax exemptions alone cost the government Rs4.3 trillion this year. That’s nearly three-quarters of total tax expenditures. A large portion—Rs1.8 trillion—was due to a zero-percent sales tax on petroleum products, even though a petroleum levy of Rs78 per litre helped recover some losses.

Read: Federal Cabinet Approves 10% Salary Increase in Budget 2025-26

Exemptions under the Fifth Schedule, covering zero-rated items, rose by a staggering 232%. Exemptions under the Sixth and Eighth Schedules also saw significant hikes, including concessions on local supplies and lower tax rates on select items. The IMF has urged Pakistan to eliminate or standardize many of these rates.

Income Tax and Customs Duty Also Climb

Income tax exemptions increased to Rs801 billion from Rs477 billion—a 68% rise. Despite increased burdens on salaried individuals, exemptions for other sectors and tax credits grew sharply. Government-related income also benefited from Rs123 billion in exemptions.

Customs duty exemptions reached Rs786 billion, a 45% increase. Concessions granted to the auto, oil, and CPEC sectors led to heavy losses. Exemptions under the Customs Act’s Fifth Schedule jumped to Rs380 billion.

FBR Responds to Reporting Errors

A senior FBR official admitted that the Rs5.8 trillion figure may have included double counting and losses from petroleum taxes. The government plans to revise these numbers online.

Despite these explanations, the steep rise in tax exemptions continues to puzzle both economists and the public.

Follow us on Google News, Instagram, YouTube, Facebook,Whats App, and TikTok for latest updates