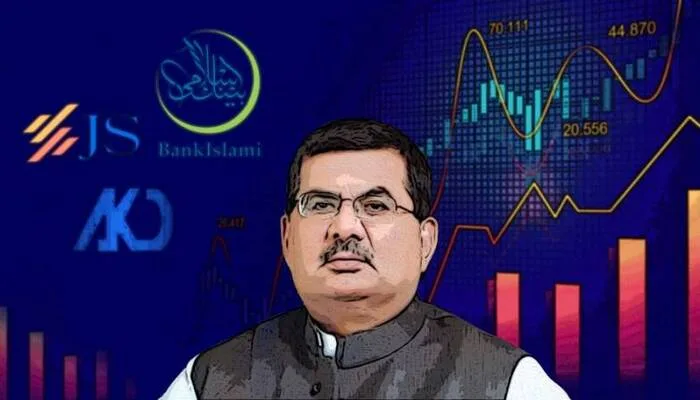

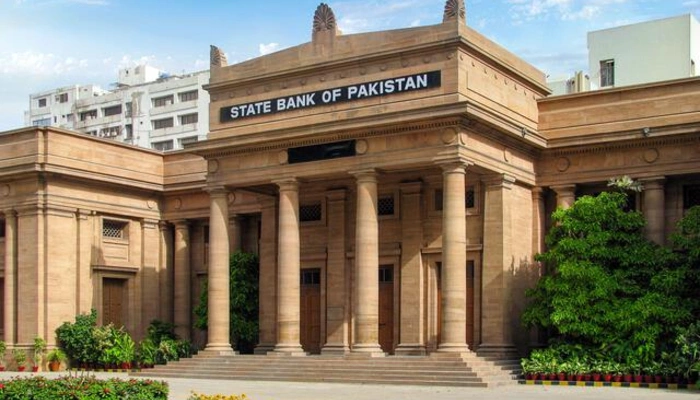

KARACHI, April 19, 2025: In a major push towards digital transformation, Deputy Governor of the State Bank of Pakistan (SBP), Mr. Saleemullah, inaugurated the ‘Go Cashless’ campaign at a bustling local mall in Clifton, Karachi. Organized in collaboration with 12 leading financial institutions, the campaign aims to raise awareness among vendors and consumers about the benefits of digital payments and promote a shift towards a cashless economy.

Promoting a Cash-Lite Economy

While speaking at the event, Mr. Saleemullah emphasized that the initiative is part of a broader national vision to accelerate Pakistan’s transition towards a digitally inclusive financial ecosystem.

“This campaign is not just an event—it’s a movement toward building a cash-lite economy where digital transactions become the norm, not the exception,” he stated.

The SBP official also explained that by making digital payments more accessible and user-friendly, the central bank aims to empower small vendors, retailers, and everyday consumers alike.

Raast: Transforming Pakistan’s Digital Landscape

Highlighting the performance of SBP’s digital infrastructure, Mr. Saleemullah revealed impressive statistics:

-

The Raast instant payment system processed 795.7 million transactions worth PKR 6.4 trillion in Q2 of 2025 alone.

-

Since its launch, Raast has handled over 892 million transactions, amounting to PKR 20 trillion.

-

Mobile and internet banking usage surged by 62%, showcasing strong public confidence in digital banking.

-

In FY24, digital transaction volumes grew by 35%, jumping from Rs. 4.7 billion to Rs. 6.4 billion, while transaction value reached Rs. 547 trillion.

These figures reflect growing public adoption of digital solutions and the strong foundation laid by SBP for a modern, secure, and inclusive digital financial environment.

Empowering Communities Through Awareness

The ‘Go Cashless’ campaign serves as a grassroots initiative to educate the public on how to use digital wallets, QR code payments, and mobile banking apps securely and efficiently.

Through on-ground demos, informational booths, and interactive sessions, the campaign engaged hundreds of shoppers, shopkeepers, and mall staff to demonstrate how easy and reliable digital transactions can be.

Mr. Saleemullah also emphasized that financial inclusion lies at the heart of this effort. Whether it’s a small fruit vendor in a local mandi or a large retail outlet, the SBP’s vision is to ensure equal access to digital financial services for everyone.

A Glimpse into the Future

This campaign showcases what the future of digital payments in Pakistan looks like—inclusive, innovative, and integrated. With strong partnerships between the central bank and commercial banks, the foundation for a cashless society is being laid one step at a time.

As Mr. Saleemullah noted, “Going cashless is not just convenient—it’s secure, efficient, and empowering. It’s the future of financial transactions in Pakistan.”

Follow us on Google News, Instagram, YouTube, Facebook, Whats App, and TikTok for latest updates